2.2 — Markets & Prices

ECON 317 • Economic Development • Fall 2021

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/devF21

devF21.classes.ryansafner.com

The Fundamental Purpose of Markets

The Origins of Exchange I

Why do we trade?

Resources are in the wrong place!

People have better uses of resources than they are currently being used!

The Origins of Exchange II

Why are resources in the wrong place?

We have the same stuff but different preferences

The Origins of Exchange III

Why are resources in the wrong place?

We have different stuff and different preferences

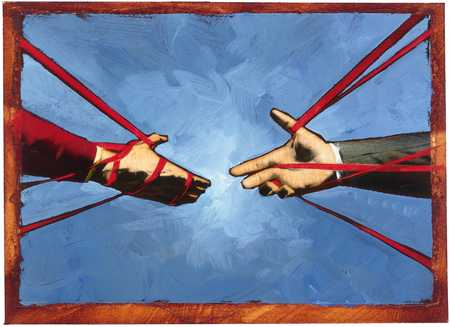

Transaction Costs and Exchange I

- But Transaction costs!

- Search costs: cost of finding trading partners

- Bargaining costs: cost of reaching an agreement

- Enforcement costs: trust between parties, cost of upholding agreement, dealing with unforeseen contingencies, punishing defection, using police and courts

Transaction Costs and Exchange II

With high transaction costs, resources cannot be traded

Resources cannot be switched to higher-valued uses

If others value goods higher than their current owners, resources are inefficiently allocated!

Transaction Costs and Exchange III

Markets are institutions that facilitate voluntary impersonal exchange and reduce transaction costs

There's a lot of background institutions necessary to facilitate markets:

- Prices, profits and losses, property rights, rule of law, contract enforcement, dispute resolution, protection, trust

Transaction Costs and Exchange III

All of those are assumed to exist and work well when we model markets in economics courses!!

Other PSCI/ECON courses: how do various political & social institutions enable markets to flourish? (some of my courses):

- ECON 315: Economics of the Law

- ECON 317: Economics of Development

- ECON 324: Industrial Organization

- ECON 470: Public Economics

Social Problems that Markets Solve Well

Problem 1: Resources have multiple uses and are rivalrous

Problem 2: Different people have different subjective valuations for uses of resources

It is inefficient (immoral?) to use a resource in a way that prevents someone else who values it more from using it!

Social Problems that Markets Solve Well

Solution: Prices in a functioning market accurately measure opportunity cost of using resources in a particular way

The price of a resource is the amount someone else is willing to pay to acquire it from its current use/owner

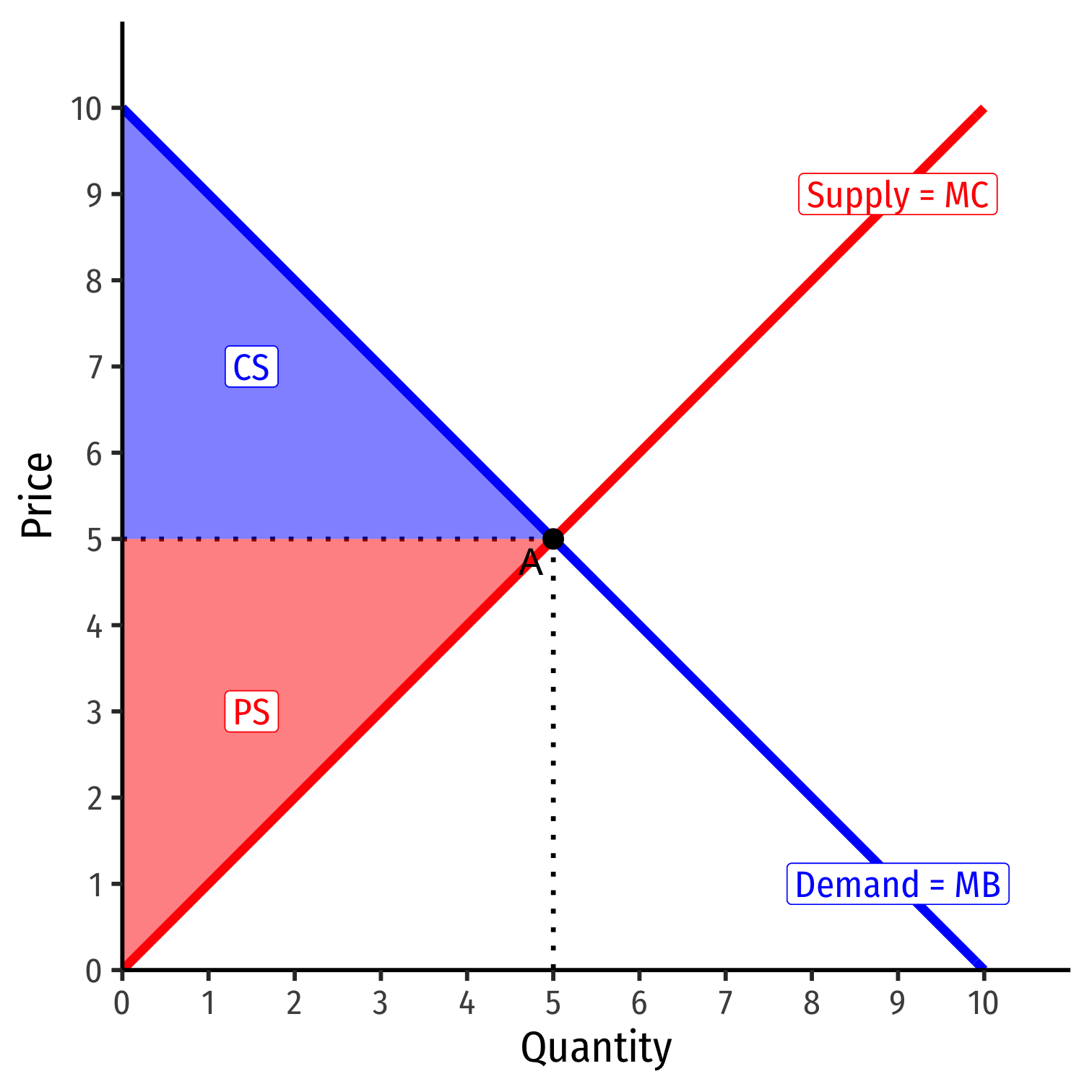

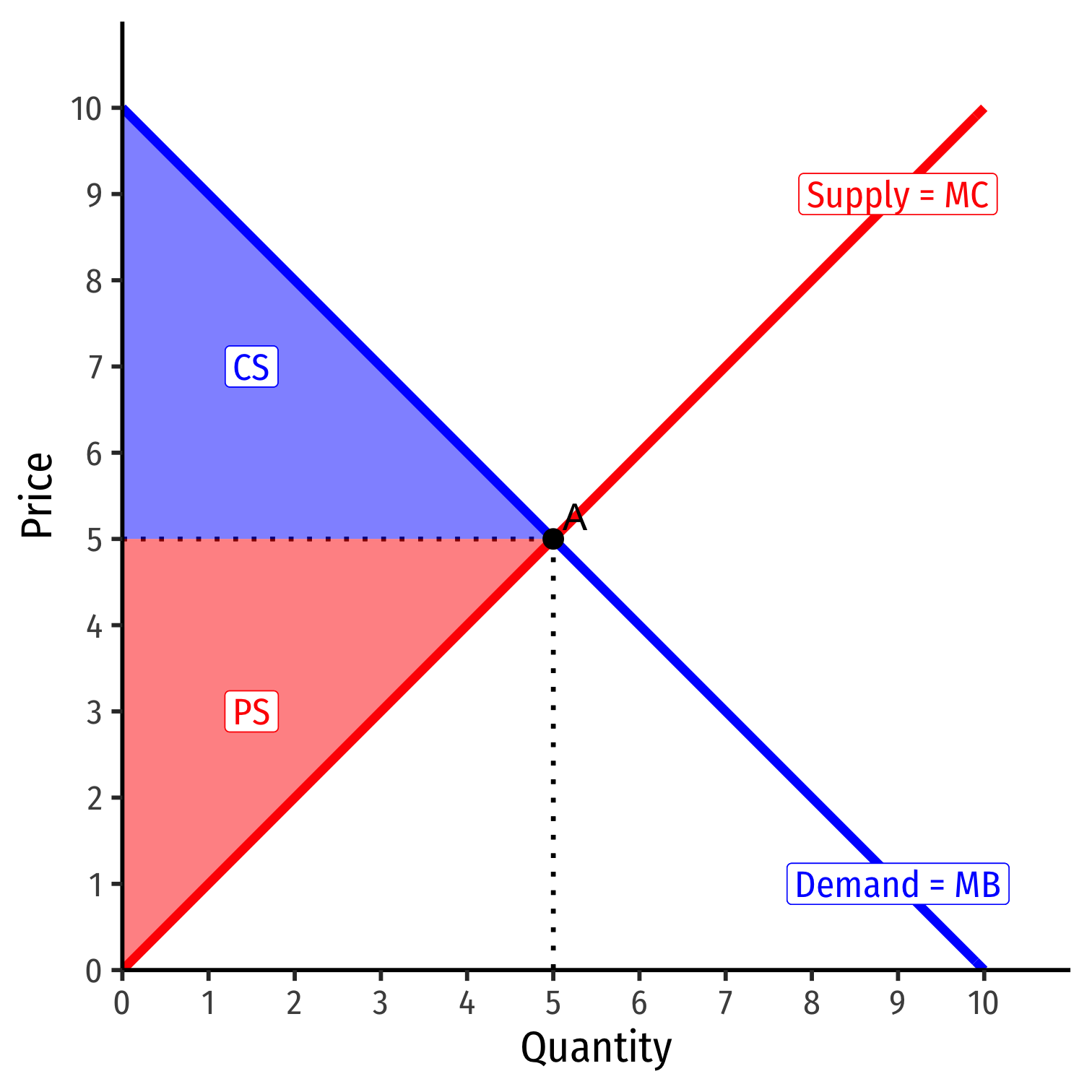

The Static Benefits of Markets

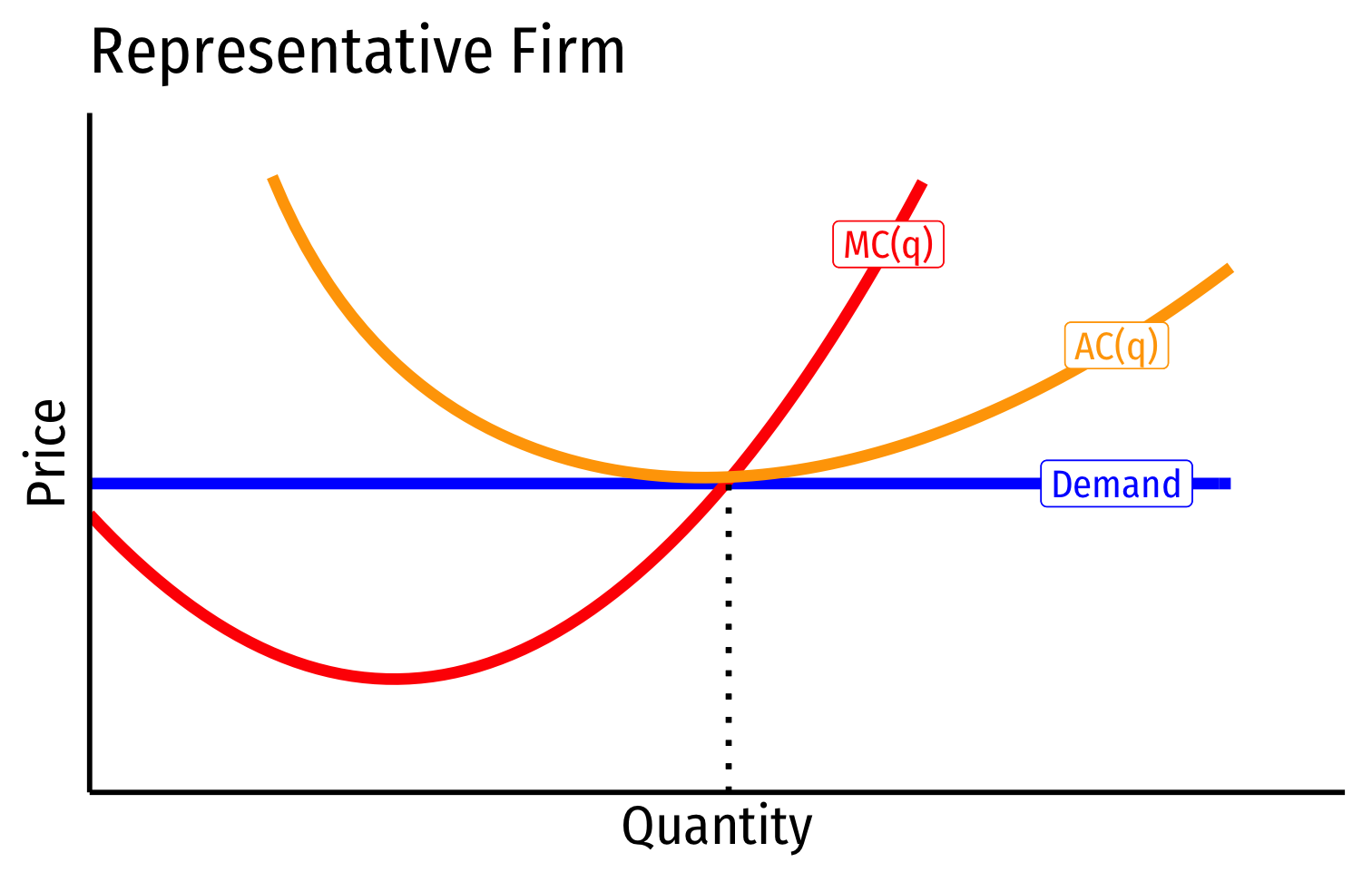

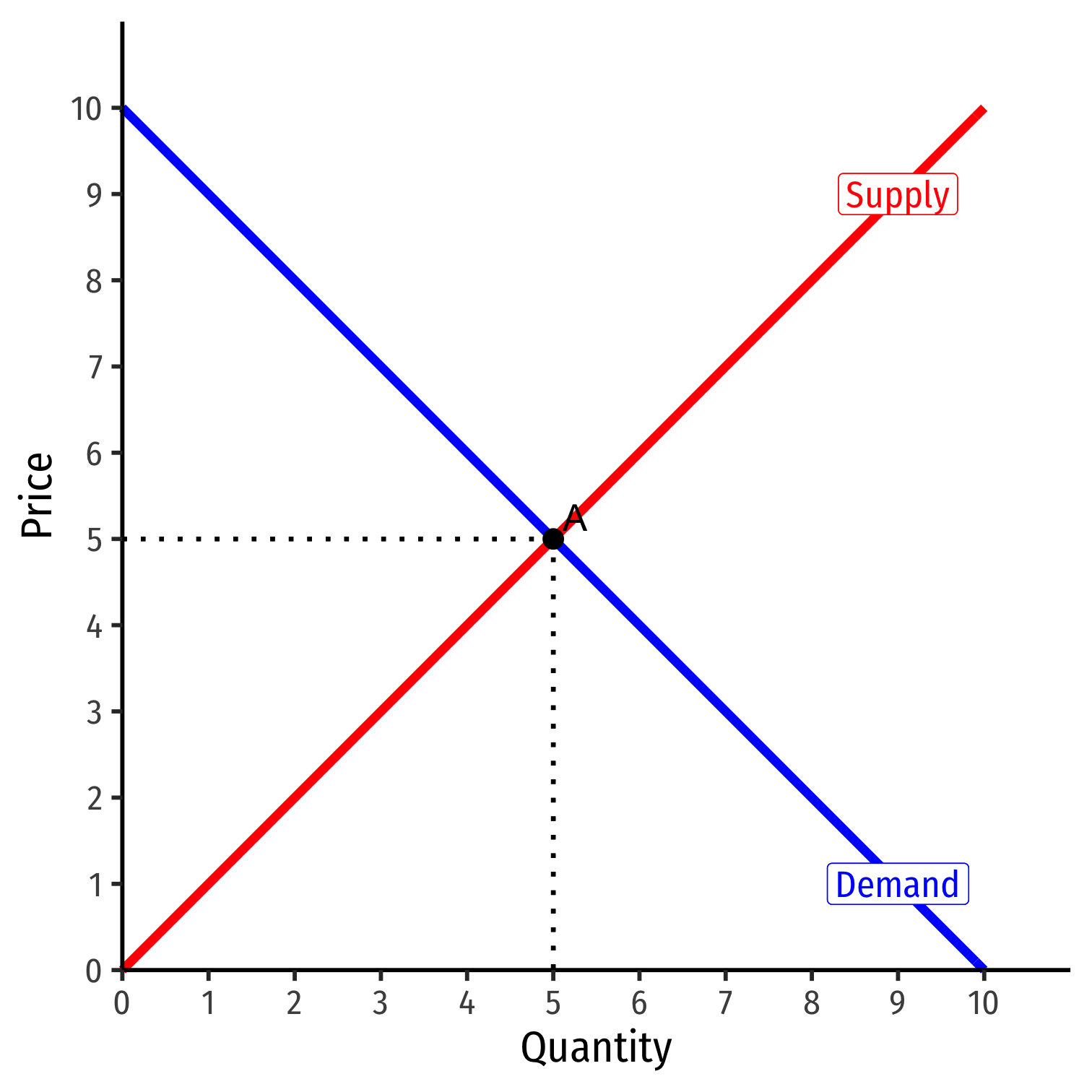

Perfectly Competitive Market

- In a competitive market in long run equilibrium:

- Economic profit is driven to $0; resources (factors of production) optimally allocated

- Allocatively efficient: p=MC(q), maximized CS + PS

- Productively efficient: p=AC(q)min (otherwise firms would enter/exit)

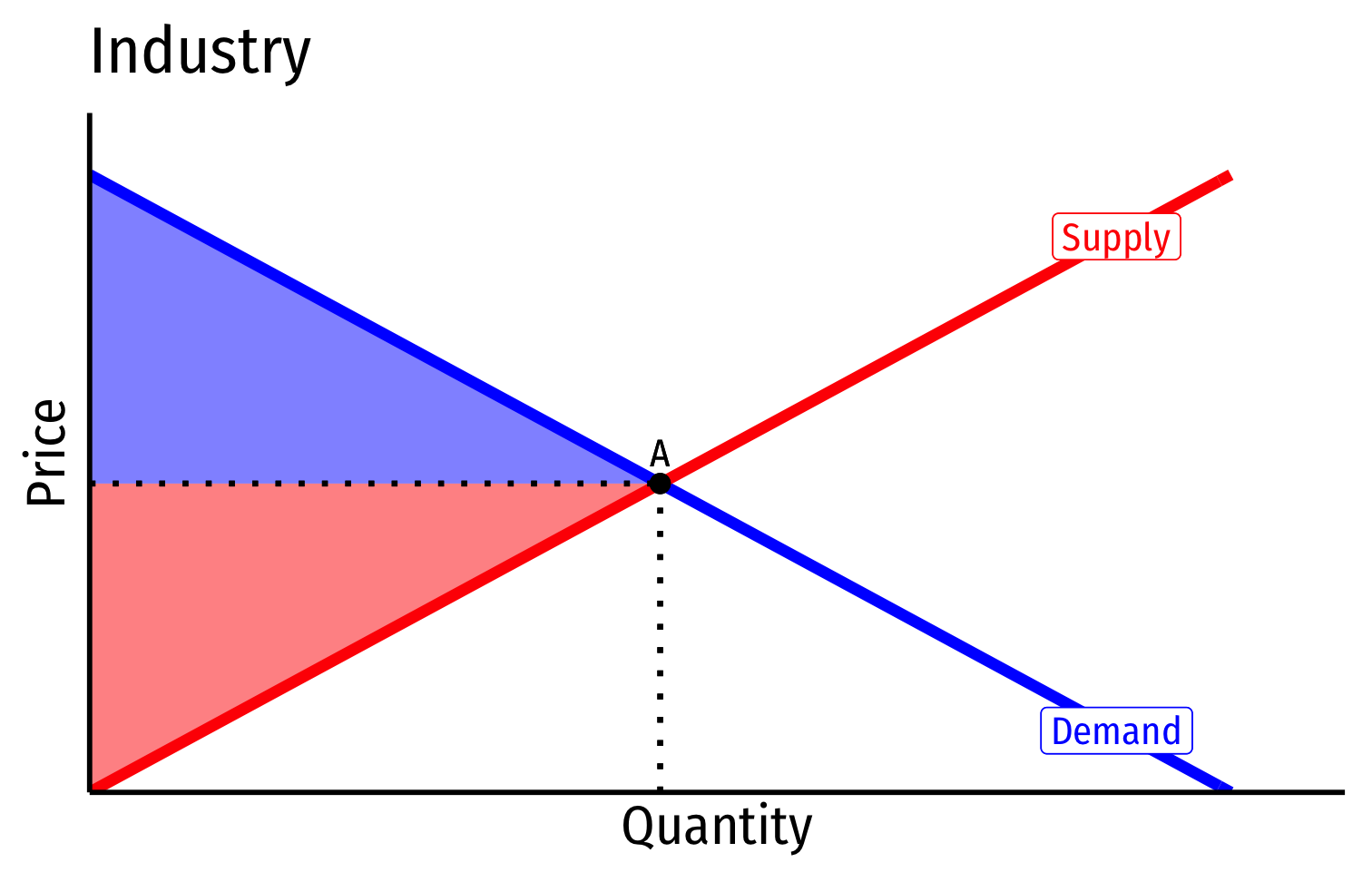

Allocative Efficiency in Competitive Equilibrium I

- Allocative efficiency: resources are allocated to highest-valued uses

- Goods are produced up to the point where marginal benefit = marginal costs

Allocative Efficiency in Competitive Equilibrium II

Economic surplus = Consumer surplus + Producer surplus

Maximized in competitive equilibrium

Resources flow away from those who value them the lowest (min WTA) to those that value them the highest (max WTP)

- creating PS and CS

The social value of resources is maximized by allocating them to their highest valued uses!

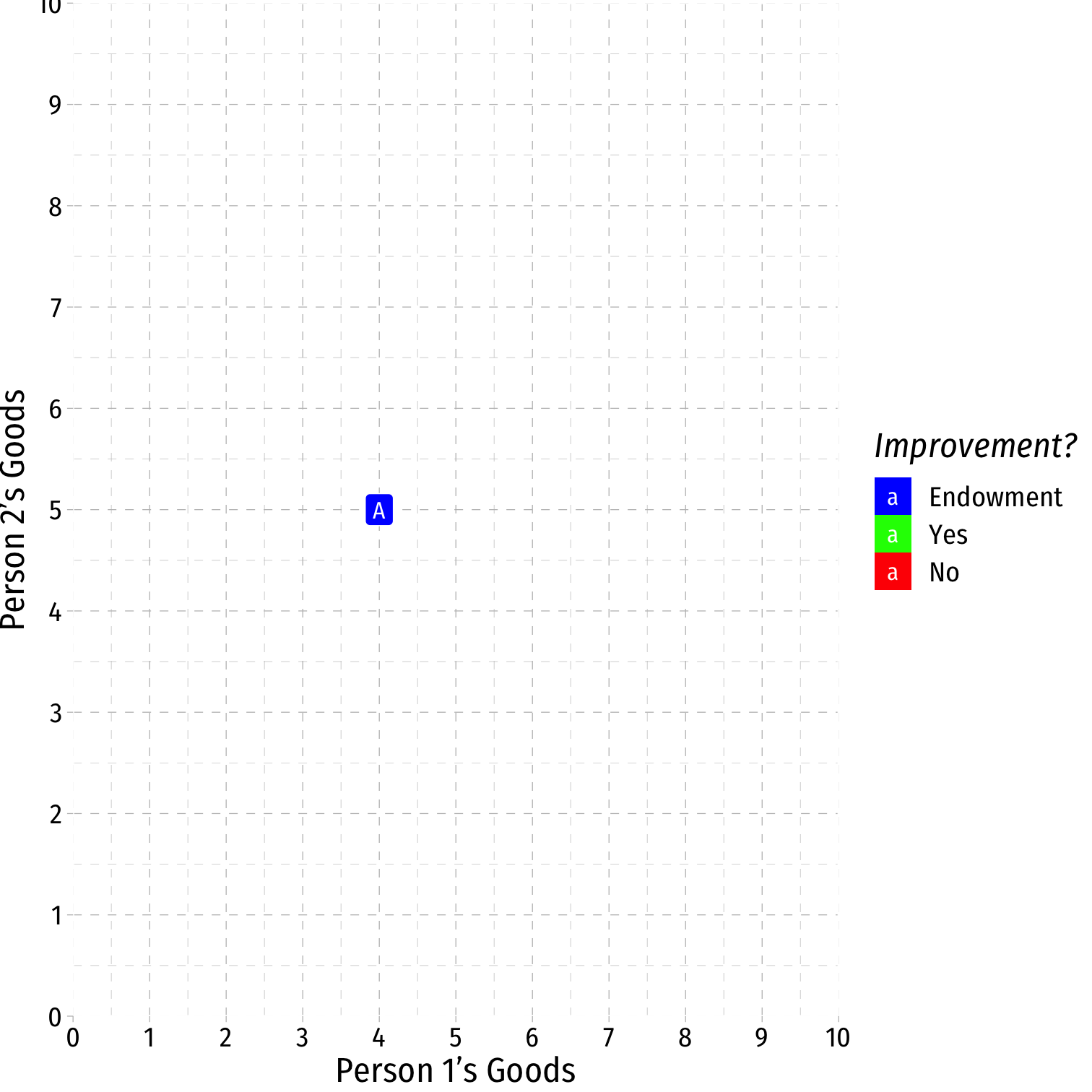

Markets and Pareto Efficiency

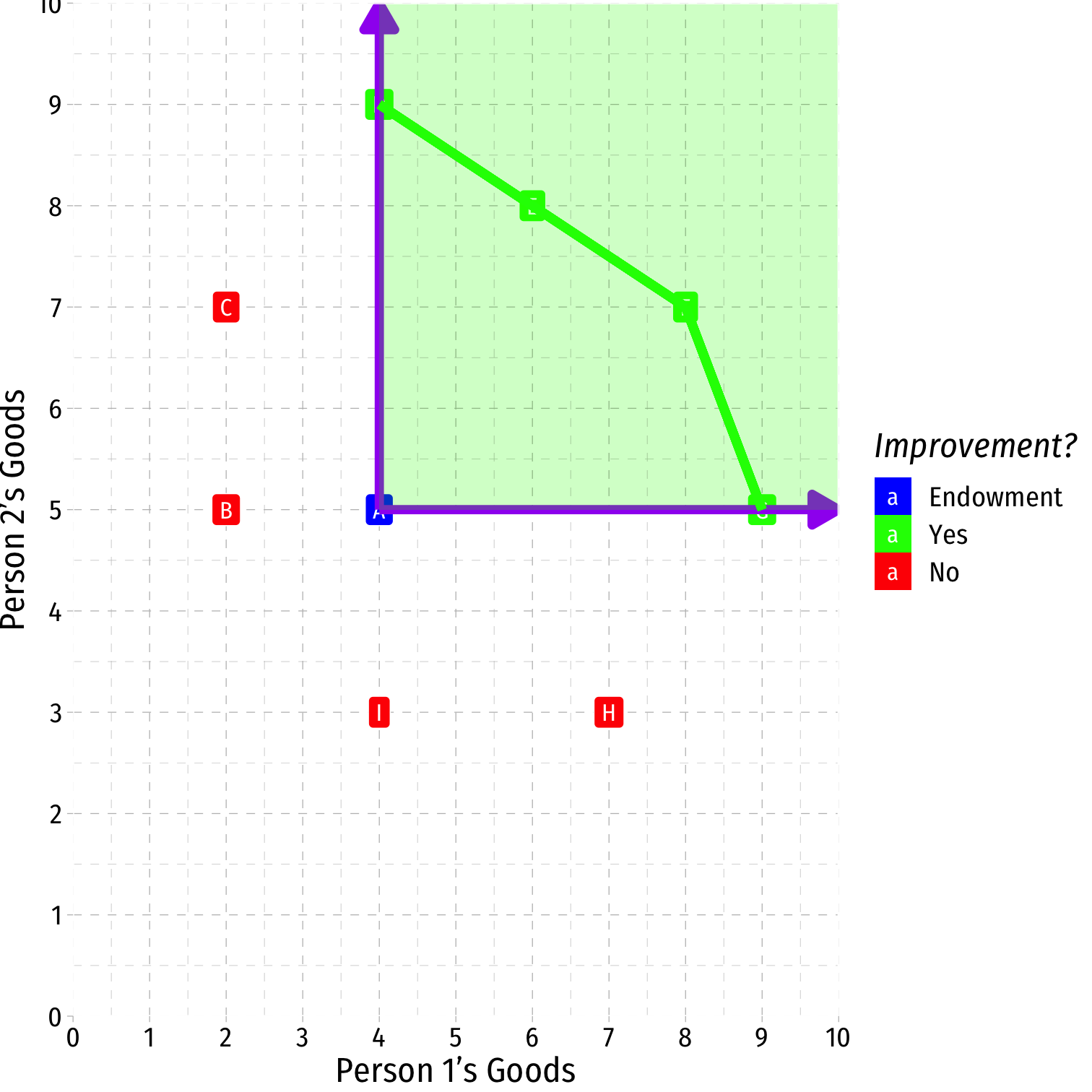

- Suppose we start from some initial allocation (A)

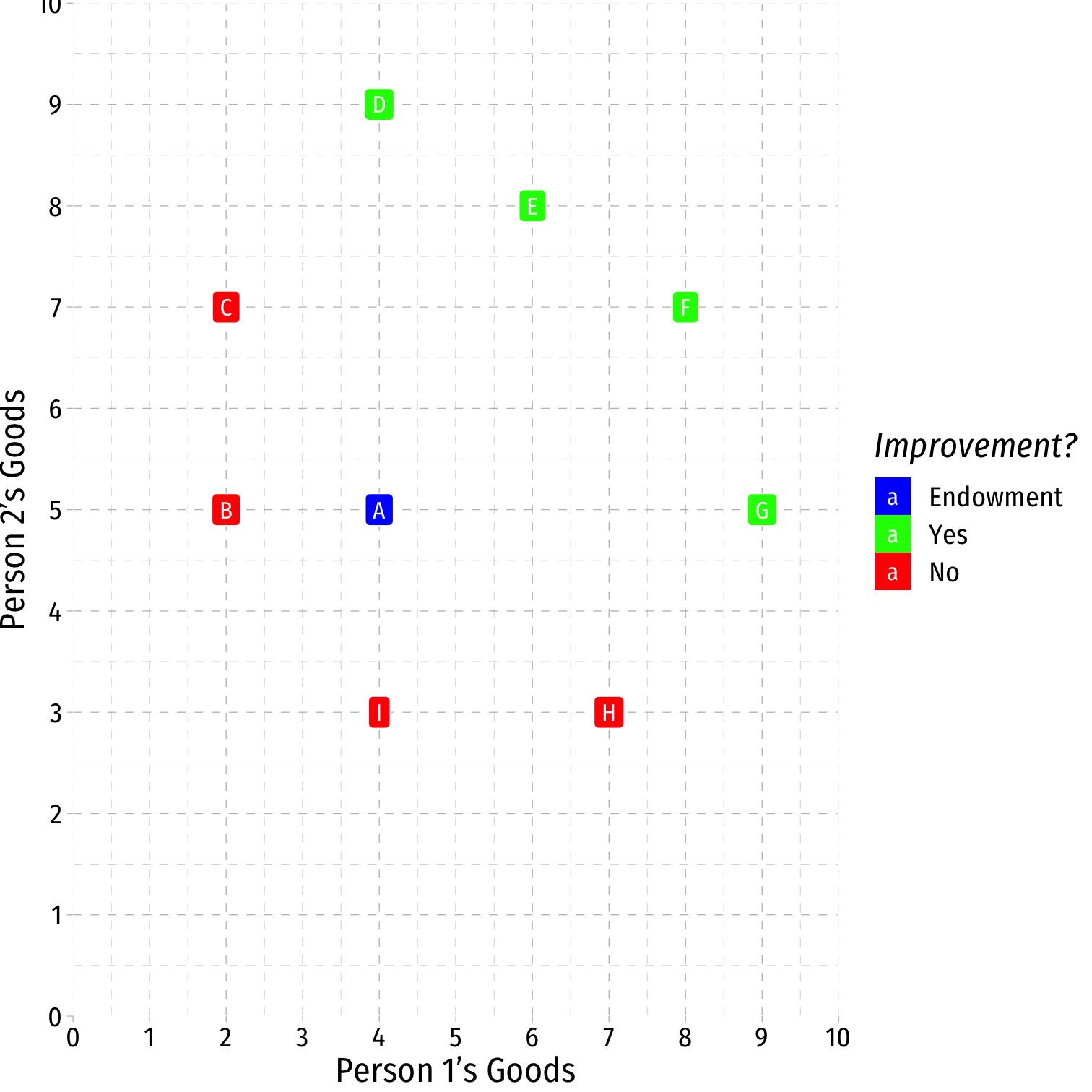

Markets and Pareto Efficiency

Suppose we start from some initial allocation (A)

Pareto Improvement: at least one party is better off, and no party is worse off

- D, E, F, G are improvements

- B, C, H, I are not

Markets and Pareto Efficiency

Suppose we start from some initial allocation (A)

Pareto Improvement: at least one party is better off, and no party is worse off

- D, E, F, G are improvements

- B, C, H, I are not

Pareto optimal/efficient: no possible Pareto improvements

- Set of Pareto efficient points often called the Pareto frontier

- Many possible efficient points!

Markets and Pareto Efficiency

Voluntary exchange in markets is a Pareto improvement

In equilibrium, markets are Pareto efficient: there are no more possible Pareto improvements

- all gains from trade exhausted, qS=qD, no pressure for change

Note Pareto efficiency contains a normative claim about equity

- It might be possible to improve the total welfare of society

- But if this comes at the expense of even 1 individual, it’s not a Pareto improvement!

Welfare Economics

1st Fundamental Welfare Theorem: markets in competitive equilibrium maximize (allocative, Pareto, productive) efficiency

- initial endowments does not affect efficiency but does affect final distribution

2nd Fundamental Welfare Theorem: any desired Pareto efficient distribution can be achieved with a one-time redistribution, and then let markets operate freely

- allows a desired distribution to be achieved without sacrificing efficiency

Welfare Economics

- Markets are great when:

- They are Competitive: many buyers and many sellers

- They each equilibrium (prices are free to adjust): absence of transactions costs or policies preventing prices from adjusting to meet supply and demand

- There are no externalities† are present: costs and benefits are fully internalized by the parties to transactions

Welfare Economics

- Markets are great when:

- They are Competitive: many buyers and many sellers

- They each equilibrium (prices are free to adjust): absence of transactions costs or policies preventing prices from adjusting to meet supply and demand

- There are no externalities† are present: costs and benefits are fully internalized by the parties to transactions

- If any of these conditions are not met, we have market failure

- May be a role for governments, other institutions, or entrepreneurs to fix

† Or public goods, or asymmetric information. But in essence, I am treating these as special cases of more common externalities.

The Dynamic Benefits of Markets

The Law of One Price I

- Law of One Price: all units of the same good exchanged on the market will tend to have the same market price (the market-clearing price, p∗)

The Law of One Price II

Consider if there are multiple different prices for same good:

Arbitrage opportunities: optimizing individuals recognize profit opportunity:

- Buy at low price, resell at high price!

- There are possible gains from trade or gains from innovation to be had

Entrepreneurship: recognizing profit opportunities and entering a market as a seller to try to capture gains from trade/innovation

Arbitrage and Entrepreneurship I

Arbitrage and Entrepreneurship II

Arbitrage and Entrepreneurship III

Uncertainty vs. Risk

Uncertainty vs. Risk

“Known knowns”: perfect information

“Known unknowns”: risk

- We know the probability distribution of states that could happen

- We just don't know which state will be realized

- We can estimate probabilities, maximize expected value, minimize variance, etc.

Uncertainty vs. Risk

- “Unknown unknowns”: uncertainty

- We don’t even know the probability distribution of states that could happen

- No model to optimize in a world of uncertainty!

The Role of Entrepreneurial Judgment

Under true uncertainty, it’s not that we can’t assign probabilities to each outcome; we do not even have the knowledge necessary to list all possible outcomes!

Requires entrepreneurial judgment to both:

- estimate possible actions and

- estimate the likelihood of their success

Entrepreneur is central player, earns pure profits (a residual) for bearing uncertainty

Entrepreneurial Judgment

Henry Ford

1863-1947

“If I had asked people what they wanted, they would have said faster horses.” - Henry Ford

Entrepreneurial Judgment

“It's really hard to design products by focus groups. A lot of times, people don't know what they want until you show it to them.” - Steve Jobs

Uncertainty and Entrepreneurship

Mark Zuckerberg

1984-

"Why were we the ones to build [Facebook]? We were just students. We had way fewer resources than big companies. If they had focused on this problem, they could have done it. The only answer I can think of is: we just cared more. While some doubted that connecting the world was actually important, we were building. While others doubted that this would be sustainable, we were forming lasting connections."

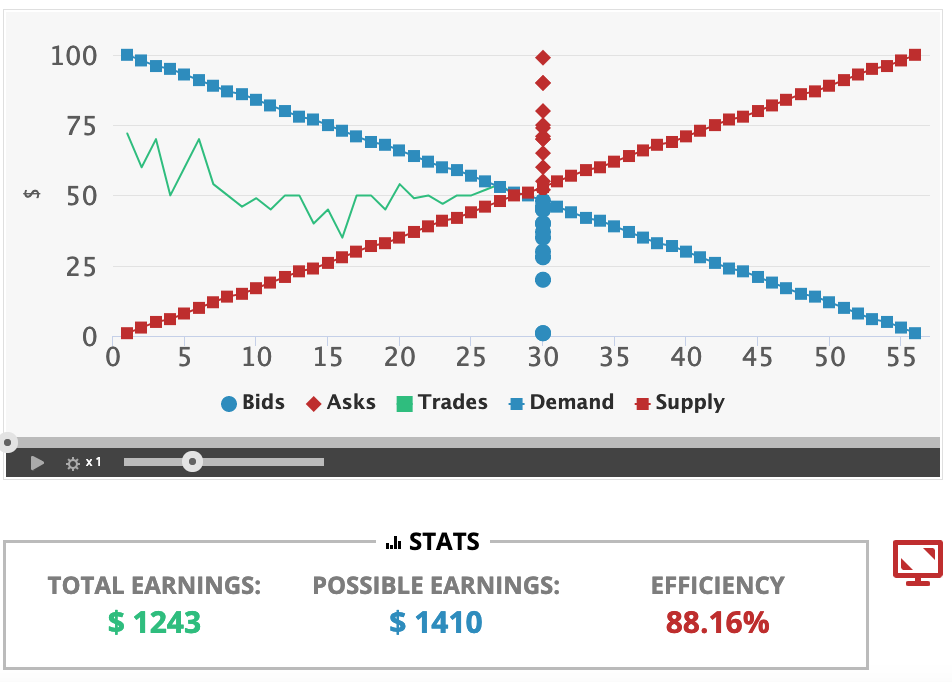

How Markets Get to Equilibrium I

Nobody knows “the right price” for things

Each buyer and seller only know their own reservation prices

Buyers and sellers adjust their bids/asks

Markets do not start competitive, but become competitive!

New entrepreneurs enter to try to capture gains from trade/innovation

As these gains are exhausted, prices converge to equilibrium

How Markets Get to Equilibrium II

Errors and imperfect information ⟹ multiple prices

- ⟹ arbitrage opportunities ⟹ entrepreneurship

- ⟹ correcting mistakes ⟹ people update their behavior & expectations

Markets are discovery processes that discover the right prices, the optimal uses of resources, and cheapest production methods, none of which can be known in advance!

How Markets Get to Equilibrium III

Economy as a cat-and-mouse game between:

- Mouse: preferences, technologies, alternative uses of resources

- Cat: market prices, least-cost technologies

Cat always chasing mouse

- Mouse always moving

- Any time cat hasn’t caught mouse: profit opportunities

IF mouse froze, market would rest at equilibrium

Prices are Signals

Markets are social processes that generate information via prices

Prices are never "given", prices emerge dynamically from negotiation and market decisions of entrepreneurs and consumers

Competition: is a discovery process which discovers what consumer preferences are and what technologies are lowest cost, and how to allocate resources accordingly

The Social Functions of Prices I

A relatively high price:

Conveys information: good is relatively scarce

Creates incentives for:

- Buyers: conserve use of this good, seek substitutes

- Sellers: produce more of this good

- Entrepreneurs: find substitutes and innovations to satisfy this unmet need

The Social Functions of Prices II

A relatively low price

Conveys information: good is relatively abundant

Creates incentives for:

- Buyers: substitute away from expensive goods towards this good

- Sellers: Produce less of this good, talents better served elsewhere

- Entrepreneurs: talents better served elsewhere: find more severe unmet needs

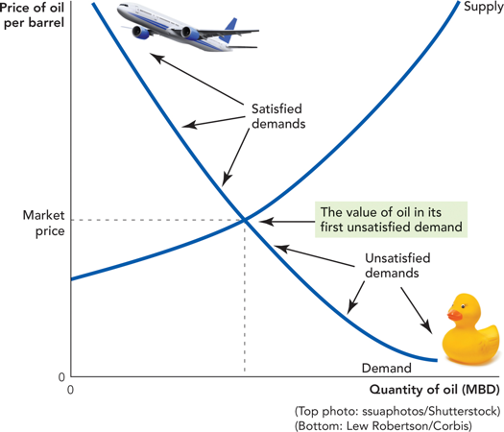

The Social Functions of Prices III

Prices tell us how to allocate scarce resources among competing uses

Think of diminishing marginal utility:

- allocate scarce good to highest-valued use first

- as supply becomes more plentiful (price falls), can allocate more units of the good to lower-valued uses (higher-valued uses already satisfied)

Uncertainty, Tacit Information, and Profit I

Economic theory: in a perfectly competitive market, in the long run, economic profit → to zero

Real world: there are often economic profits

Our blackboard models assume perfect information

In reality we have to deal with uncertainty

Uncertainty, Tacit Information, and Profit II

Imperfect information: mispricing and multiple prices → arbitrage/profit opportunities

- Some people recognize opportunities ($20 bills) that others do not see

In a world of certainty, there would be no profit

- The model world of perfect competition is a fictional world of certainty

- The real world, because it’s uncertain, has profit opportunities!

Uncertainty, Tacit Information, and Profit III

Firms don’t actually maximize profits, just a convenient assumption

- In a world of uncertainty (unlike mere risk), there’s no way to maximize anything!

Real world is not merely a constrained maximization problem!

Better to think in evolutionary terms

- Firms that best adapt to market circumstances will earn profit and merely survive

- Whether by skill and talent or just dumb luck!

Uncertainty, Tacit Information, and Profit IV

Profits and Entrepreneurship

In markets, production faces profit-test:

- Is consumer's willingness to pay > opportunity cost of inputs?

Profits are an indication that value is being created for society

Losses are an indication that value is being destroyed for society

Survival for sellers in markets requires firms continually create value and earn profits or die

Why We Need Prices, Profits, and Losses I

People often confuse the economic problem with a technological problem

Technological problem: how to allocate scarce resources to accomplish a particular goal

- e.g. buy the right combination of goods to maximize utility

- e.g. buy the right combination of inputs and produce output to maximize profits

- given stable prices, preferences, and technologies, a computer can solve this problem

Why We Need Prices, Profits, and Losses II

Economic calculation problem: how to determine which of the infinite technologically-feasible options are economically viable?

How to best make use of dispersed knowledge to coordinate conflicting plans of individuals for their own ends?

ONLY can be discovered through competition, prices, profits & losses

What if there Were No Prices? I

The Socialist Calculation Debate, Redux

Aside: Returning to the Socialist Calculation Debate

- Neoclassical economists and market socialists (Lange, Lerner, Bergson, etc) argued that central planning can, in theory, replicate the optimal outcomes of markets in competitive equilibrium without the problems of capitalism:

- Externalities

- Monopolies

- Inequality

- Unemployment

- Business cycles

The Neoclassical/Socialist View of Prices I

Prices as sufficient statistics in static equilibrium

Efficiency of prices: function in equilibrium market-clearing & achieving Pareto optimality

When prices changes, they don't lose their parametric function, and every individual always takes "the price" as given (price-taking behavior)

The Neoclassical/Socialist View of Prices II

Competition ≡ an optimal end-state (“perfect competition”):

- Consumers have maximized utility

- Producers have minimized cost

- Economic profits are zero

- No surpluses or shortages

If you find the right vector of prices, given consumer preferences and given production functions, you can calculate this optimal outcome!

Hayek's Realization From Mises

Competition is not an optimal end-state, it is a discovery process!

Competition is not a noun (perfect competition), it's an (active) verb!

- It cannot be known in advance!

Hayek: Markets as a Discovery Process I

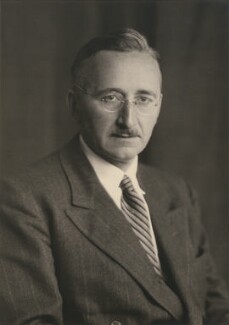

F. A. Hayek

1899-1992

Economics Nobel 1974

"Planning in the specific sense in which the term is used in contemporary controversy necessarily means central planning - direction of the whole economic system according to one unified plan. Competition, on the other hand, means decentralized planning by many separate persons," (pp.519-520).

Hayek, F. A., 1945, "The Use of Knowledge in Society," American Economic Review 35(4): 519-530

Hayek: Markets as a Discovery Process II

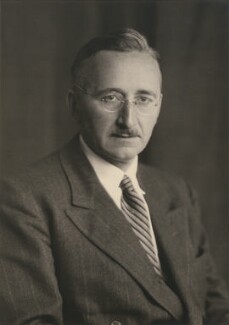

F. A. Hayek

1899-1992

Economics Nobel 1974

"The economic problem of society is thus not merely a problem of how to allocate given resources if given is taken to mean given to a single mind which deliberately solves the problem set by these data. It is rather a problem of how to secure the best use of resources known to any of the members of society, for ends whose relative importance only these individuals know. Or, to put it briefly, it is a problem of the utilization of knowledge which is not given to anyone in its totality," (pp.519-520).

Hayek, F. A., 1945, "The Use of Knowledge in Society," American Economic Review 35(4): 519-530

Hayek: Markets as a Discovery Process II

Hayek: Markets as a Discovery Process III

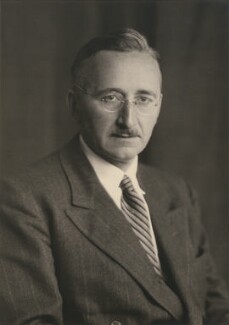

F. A. Hayek

1899-1992

Economics Nobel 1974

"Which of the systems is likely to be more efficient...depends on whether we are more likely to succeed in putting at the disposal of a single central authority all the knowledge which ought to be used but which is initially dispersed among many different individuals, or in conveying to the individuals such additional knowledge as they need in order to enable them to fit their plans with those of others," (pp.519-520).

Hayek, F. A., 1945, "The Use of Knowledge in Society," American Economic Review 35(4): 519-530

Hayek: Markets as a Discovery Process IV

F. A. Hayek

1899-1992

Economics Nobel 1974

"The marvel is that in a case like that of a scarcity of a raw material, without an order being issued, without more than perhaps a handful of people knowing the cause, tens of thousands of people whose identity could not be ascertained by months of investigation, are made to use the material or its products more sparingly," (pp.527).

Hayek, F. A., 1945, "The Use of Knowledge in Society," American Economic Review 35(4): 519-530

Hayek: Markets as a Discovery Process IV

F. A. Hayek

1899-1992

Economics Nobel 1974

"The problem arises because one of the most important forces which in a truly competitive economy brings about the reduction of costs to the minimum discoverable will be absent, namely, price competition...[T]he question is frequently treated as if the cost curves were objectively given facts. What is forgotten is that the method which under given conditions is the cheapest is a thing which has to be discovered, and to be discovered anew, sometimes almost from day to day, by the entrepreneur, and that, in spite of the strong inducement, it is by no means regularly the established entrepreneur, the man in charge of the existing plant, who will discover what is the best method," (p.196).

Hayek, F. A., 1948, "Socialist Calculation II: The Competitive Solution," Individualism and Economic Order

Hayek: Markets as a Discovery Process V

F. A. Hayek

1899-1992

Economics Nobel 1974

"The force which in a competitive society brings about the reduction of price to the lowest cost...is the opportunity for anybody who knows a cheaper method to come in at his own risk and to attract customers by underbidding the existing producers. But, if prices are fixed by the authority, this method is excluded," (p.196).

Hayek, F. A., 1948, "Socialist Calculation II: The Competitive Solution," Individualism and Economic Order

Mises-Hayek View of Prices

Prices are knowledge surrogates in dynamic disequilibrium

Efficiency of prices: use distributed knowledge and incentivize local actors to exploit opportunities, which reduce error and bring about greater social coordination

Prices are never "given", prices emerge dynamically from negotiation and market decisions of entrepreneurs and consumers

Competition: is a discovery process which discovers what consumer preferences are and what technologies are lowest cost, and how to allocate resources accordingly

The Social Functions of Prices

F. A. Hayek

1899-1992

Economics Nobel 1974

"The most significant fact about this system is the economy of knowledge with which it operates...by a kind of symbol [the price], only the most essential information is passed on and passed on only to those concerned...The marvel is that in a case like that of a scarcity of a raw material, without an order being issued, without more than perhaps a handful of people knowing the cause, tens of thousands of people whose identity could not be ascertained by months of investigation, are made to use the material or its products more sparingly," (p.527).

Hayek, F. A., 1945, "The Use of Knowledge in Society," American Economic Review 35(4): 519-530

Scientific vs. Tacit Knowledge

F. A. Hayek

1899-1992

Economics Nobel 1974

"Today it is almost heresy to suggest that scientific knowledge is not the sum of all knowledge. But a little reflection will show that there is beyond question a body of very important but unorganized knowledge which cannot possibly be called scientific in the sense of knowledge of general rules: the knowledge of the particular circumstances of time and place. It is with respect to this that practically every individual has some advantage over all others in that he possesses unique information of which beneficial use might be made, but of which use can be made only if the decisions depending on it are left to him or are made with his active cooperation," (pp.521-522).

Hayek, F. A., 1945, "The Use of Knowledge in Society," American Economic Review 35(4): 519-530

The Socialist Calculation Debate In Retrospect III

Main disagreement is about rivalry

Marxists: rivalry as inherent flaw in capitalism leading to conflict; central planning removes rivalry and leads to pre-coordinated harmony

Mises-Hayek: rivalry under specific institutions (market prices, property rights) is the only way to generate the information necessary to rationally allocate resources

Neoclassical economists: assume rivalry away in perfect competition models, viewing prices as just parametric statistics, allowing a central planner to achieve the same optimal outcome

Lavoie, Don, 1985, Rivalry and Central Planning: The Socialist Calculation Debate Reconsidered, p.25