3.1 — Growth Regressions & Aid Theory

ECON 317 • Economic Development • Fall 2021

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/devF21

devF21.classes.ryansafner.com

Unit III

In this unit, we will consider a lot of explanations for variation in GDP per capita

Focus on things that are external or a country cannot control

- Foreign Aid (as recipient)

- Geographical features

Unit III

Today and next class (and discussion) will be about Foreign Aid

But first, today, we will have to spend some time talking about the empirics of development literature

- Growth regressions

- Program evaluation

All comes down to regression models

Digression: Growth Regressions & Program Evaluation

Growth Regressions

Development papers are very empirical

Take data (of varying quality) from countries around the world and try to see:

What factors explain variation in GDP per capita around the world?

Dependent variable Y: GDP per capita (or growth rate)

Independent variables X1,X2,⋯Xk: things that can plausibly affect GDP per capita

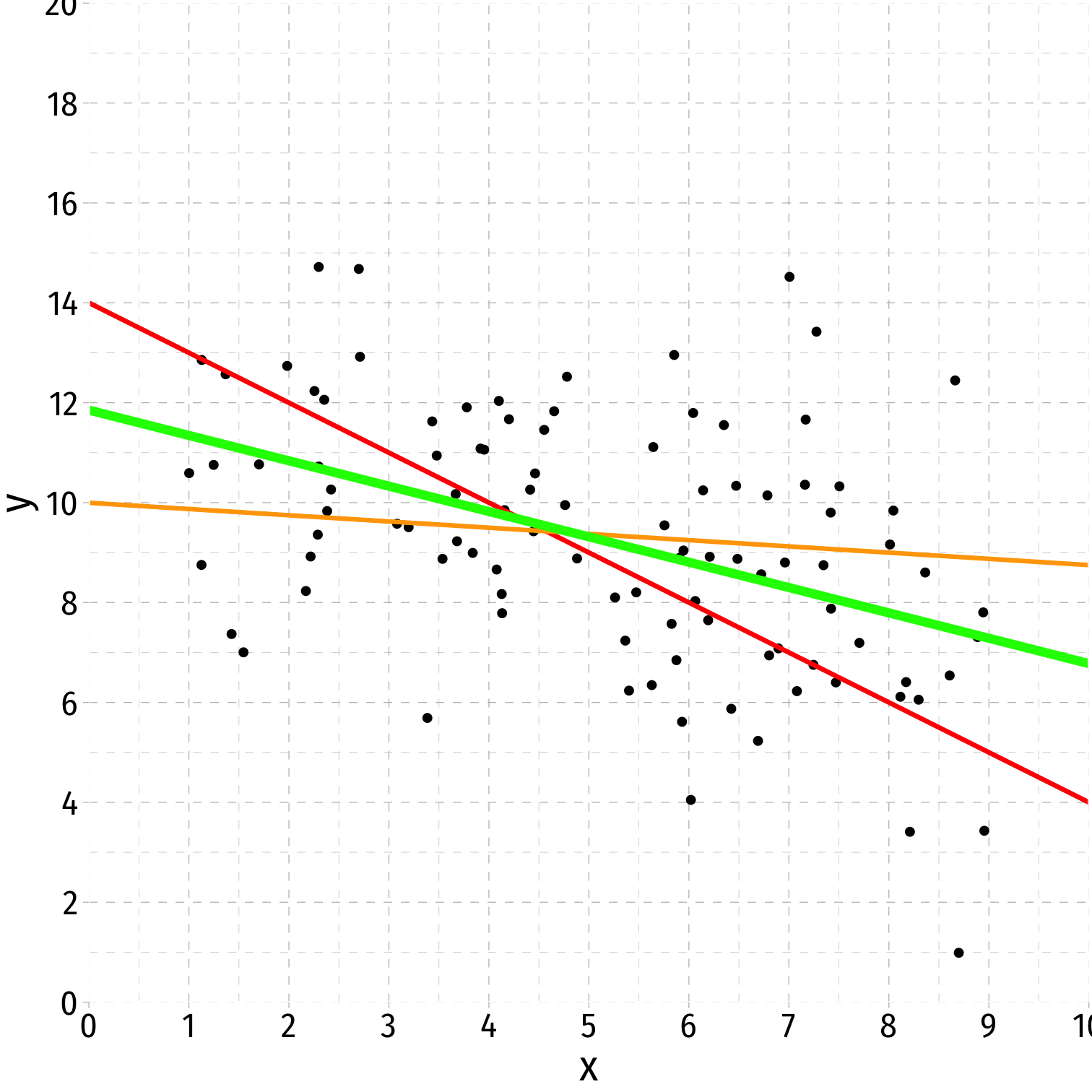

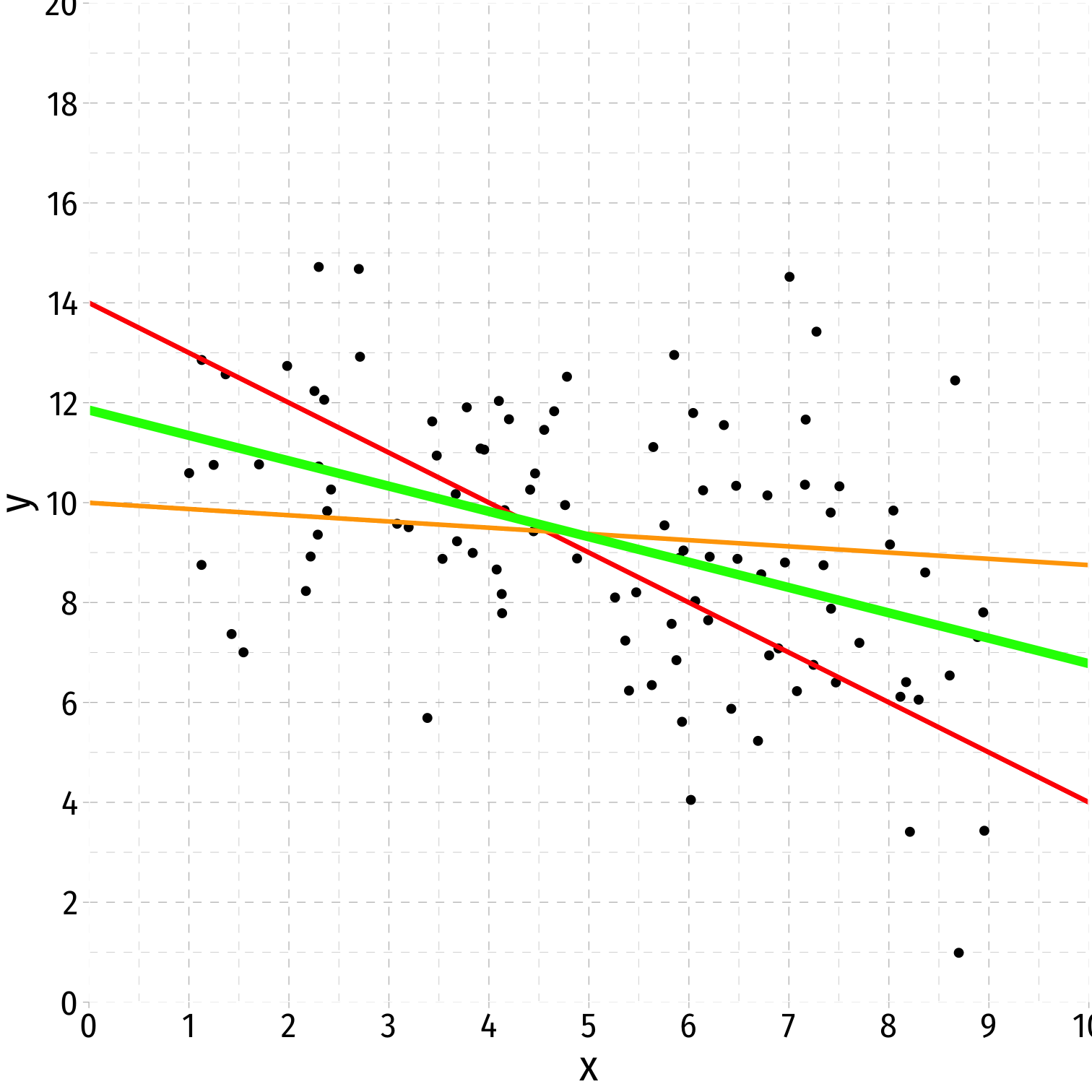

Linear Regression

- Linear regression is the process of fitting a line to data

Y=β0+β1X+u

β0: intercept (Y when X=0)

β1: slope, the marginal effect of X on Y: ΔYΔX

u: error term, contains everything other than X that affects Y

Linear Regression

This idea of a “line through data points” is simplified, just to give you intuition

- Can be nonlinear, curves, etc.

- More than one X variable

- More advanced methods and models

If you want to know more, take my econometrics class

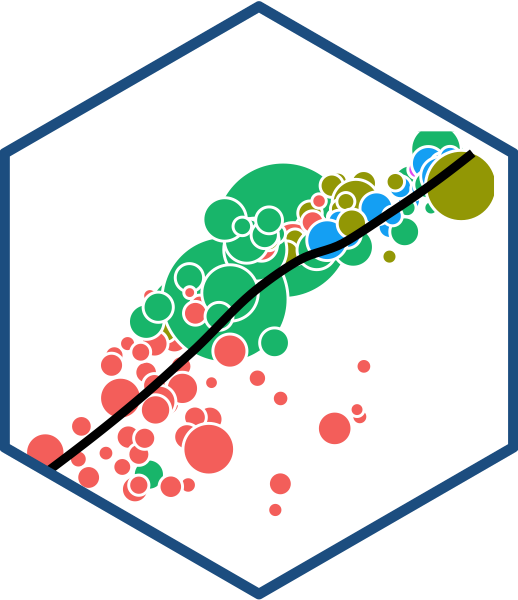

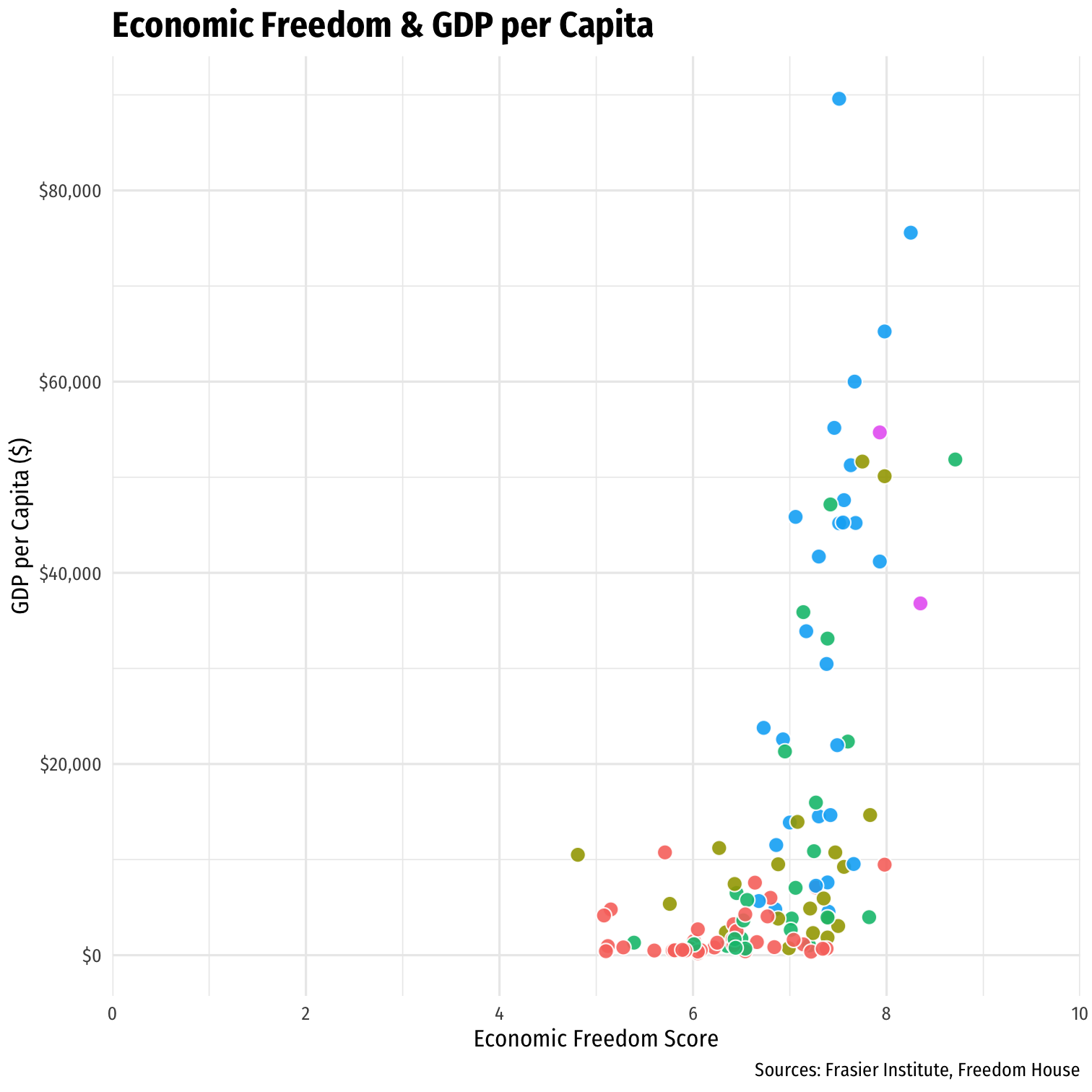

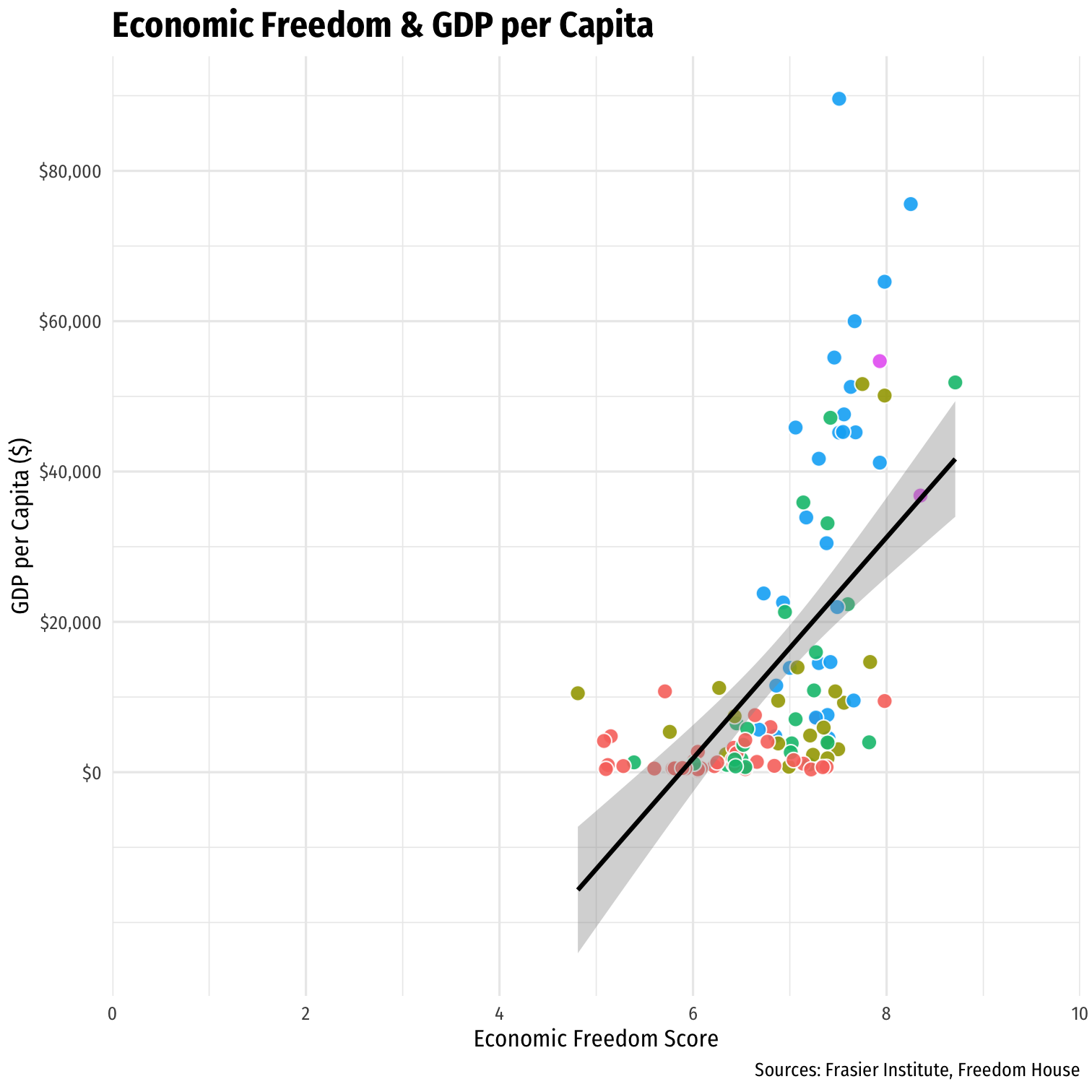

Linear Regression: Example

Some data on economic freedom and gdp per capita

Suppose we want to estimate a regression model

^gdp per capita=β0+β1ef

Linear Regression: Example

- Estimated regression equation:

^GDP per capita=−86,400+14704ef

Intercept (β0): -86,400

- Predicted GDP per capita for an economic freedom score of 0

- Not often interpretable

Slope (β1): 14,704

- The marginal effect of economic freedom on GDP per capita

- A 1 point increase in Economic Freedom (0-10) increases GDP per capita by $14,704

How to Read a Regression Table

Regression results are presented in a table like this

- Estimates of β0 and β1

- Standard errors of β0 and β1 in parentheses below

- Indicate statistical significance (with asterisks)

- Measures of regression fit R2, σ, etc.

Often includes multiple models (columns) and multiple independent variables (rows)

| GDP per capita | |

|---|---|

| Intercept | -86400.07 *** |

| (13361.77) | |

| Economic Freedom | 14704.30 *** |

| (1935.13) | |

| N | 112 |

| R-Squared | 0.34 |

| SER | 15881.92 |

| *** p < 0.001; ** p < 0.01; * p < 0.05. | |

How to Read a Regression Table

Again, marginal effect of Economic Freedom on GDP per capita is 14704.

R2 indicates 34% of variation in GDP per capita is explained by this (very simple) model

| GDP per capita | |

|---|---|

| Intercept | -86400.07 *** |

| (13361.77) | |

| Economic Freedom | 14704.30 *** |

| (1935.13) | |

| N | 112 |

| R-Squared | 0.34 |

| SER | 15881.92 |

| *** p < 0.001; ** p < 0.01; * p < 0.05. | |

Multivariate Regression: Motivation

Any good statistics class will repeat: correlation does not imply causation

But it can, with the right tools

- Econometrics is all about using the right tools to actually make causal inferences from sample data

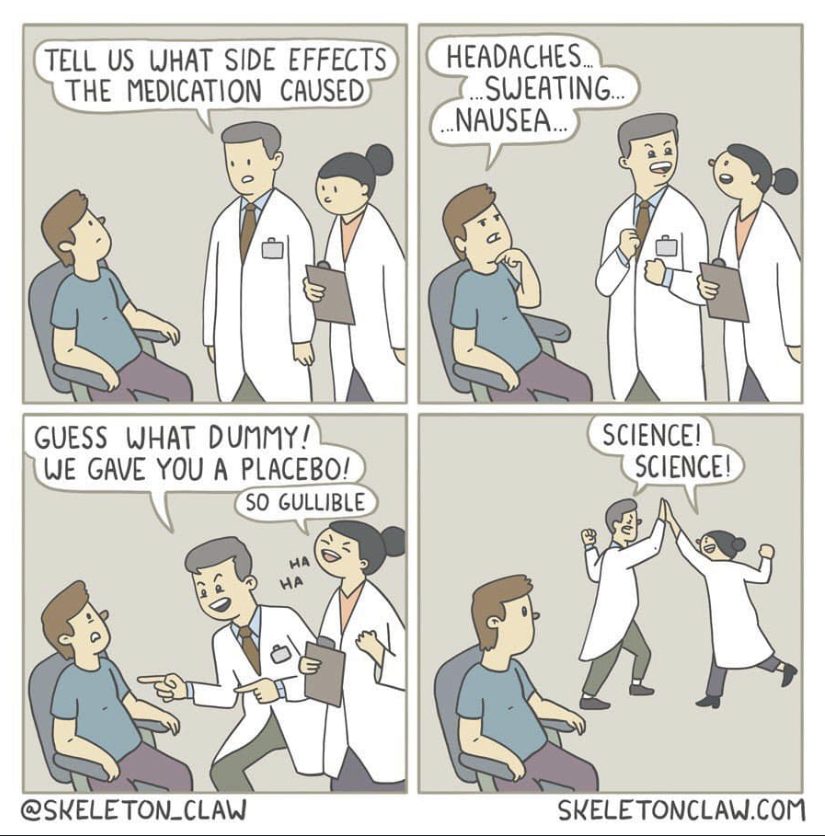

Randomized Control Trials (RCTs) I

- The ideal way to demonstrate causation is through a randomized control trial (RCT) or “random experiment”

- Randomly assign experimental units (e.g. people, firms, etc.) into groups

- Treatment group(s) get a (kind of) treatment

- Control group gets no treatment

- Compare results of treatment and control groups to observe the average treatment effect (ATE)

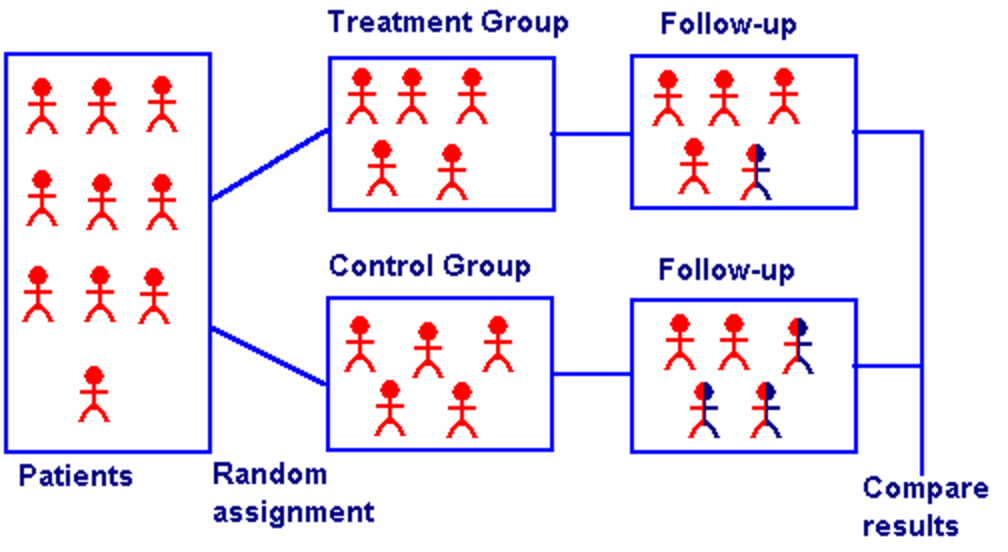

Random Control Trials (RCTs) II

Classic (simplified) procedure of a randomized control trial (RCT) from medicine

Random Control Trials (RCTs) III

Random Control Trials (RCTs) IV

- Random assignment to groups ensures that the only differences between members of the treatment(s) and control groups is receiving treatment or not

Treatment Group

Treatment Group

Control Group

Control Group

Random Control Trials (RCTs) IV

Random assignment to groups ensures that the only differences between members of the treatment(s) and control groups is receiving treatment or not

Selection bias: (pre-existing) differences between members of treatment and control groups other than treatment, that affect the outcome

Treatment Group

Treatment Group

Control Group

Control Group

(Selection Bias)

Random Assignment: The Silver Bullet

If treatment is randomly assigned for a large sample, it eliminates selection bias!

Treatment and control groups differ on average by nothing except treatment status

Creates ceterus paribus conditions in economics: groups are identical on average (holding constant age, sex, height, etc.)

Treatment Group

Treatment Group

Control Group

Control Group

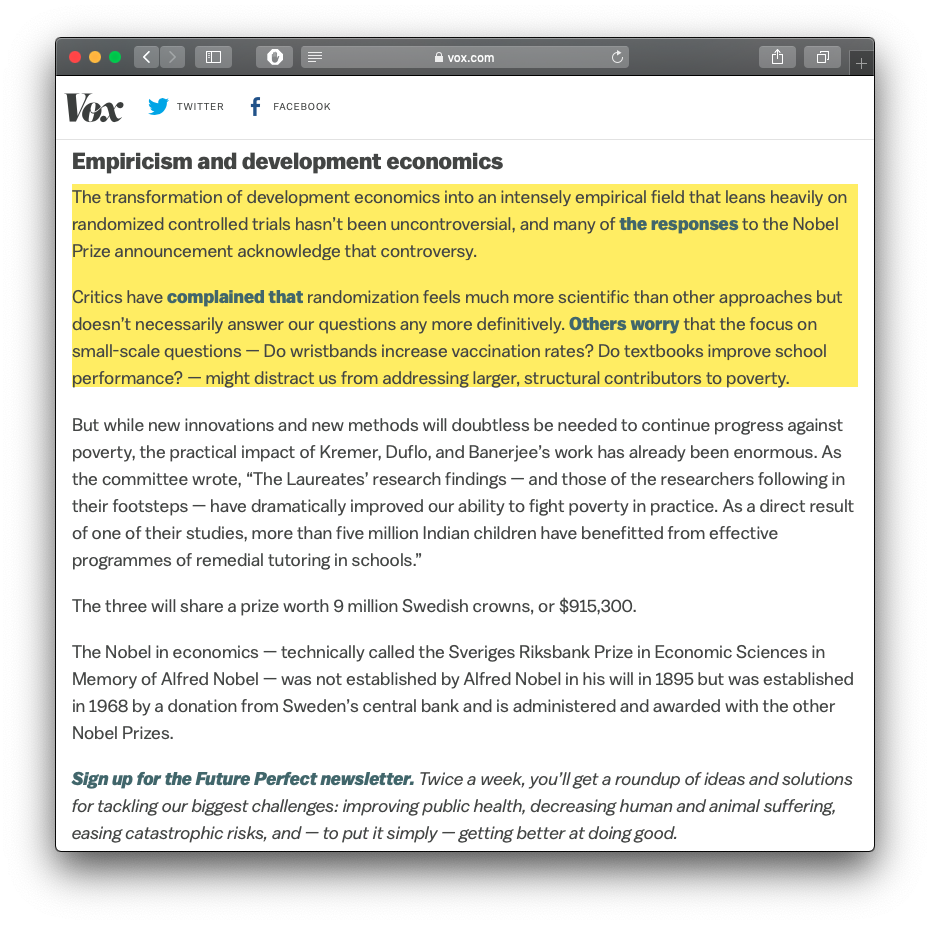

But Not Everyone Agrees I

Angus Deaton

Economics Nobel 2015

The RCT is a useful tool, but I think that is a mistake to put method ahead of substance. I have written papers using RCTs...[but] no RCT can ever legitimately claim to have established causality. My theme is that RCTs have no special status, they have no exemption from the problems of inference that econometricians have always wrestled with, and there is nothing that they, and only they, can accomplish.

Deaton, Angus, 2019, “Randomization in the Tropics Revisited: A Theme and Eleven Variations”, Working Paper

But Not Everyone Agrees II

Lant Pritchett

“People keep saying that the recent Nobelists "studied global poverty." This is exactly wrong. They made a commitment to a method, not a subject, and their commitment to method prevented them from studying global poverty.”

“At a conference at Brookings in 2008 Paul Romer (last years Nobelist) said: "You guys are like going to a doctor who says you have an allergy and you have cancer. With the skin rash we can divide you skin into areas and test variety of substances and identify with precision and some certainty the cause. Cancer we have some ideas how to treat it but there are a variety of approaches and since we cannot be sure and precise about which is best for you, we will ignore the cancer and not treat it.”

But Not Everyone Agrees III

Angus Deaton

Economics Nobel 2015

“Lant Pritchett is so fun to listen to, sometimes you could forget that he is completely full of shit.”

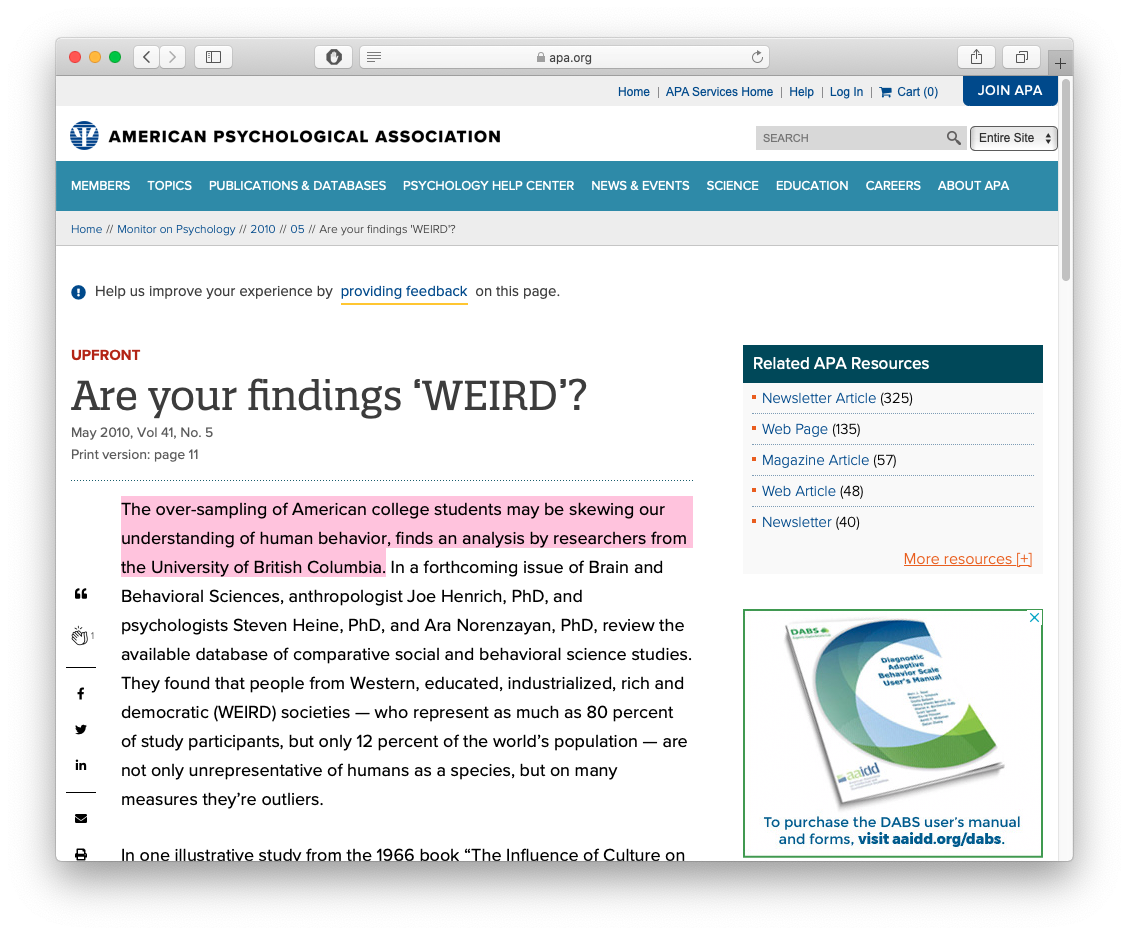

RCTs and External Validity

Even if a study is internally valid (used statistics correctly, etc.) we must still worry about external validity:

Is the finding generalizable to the whole population?

If we find something in India, does that extend to Bolivia? France?

Subjects of studies & surveys are often WEIRD: Western, Educated, and from Industrialized Rich Democracies

RCTs and External Validity

RCTs and External Validity

IN MICEhttps://t.co/mLuKBRhsAb

— justsaysinmice (@justsaysinmice) September 15, 2020

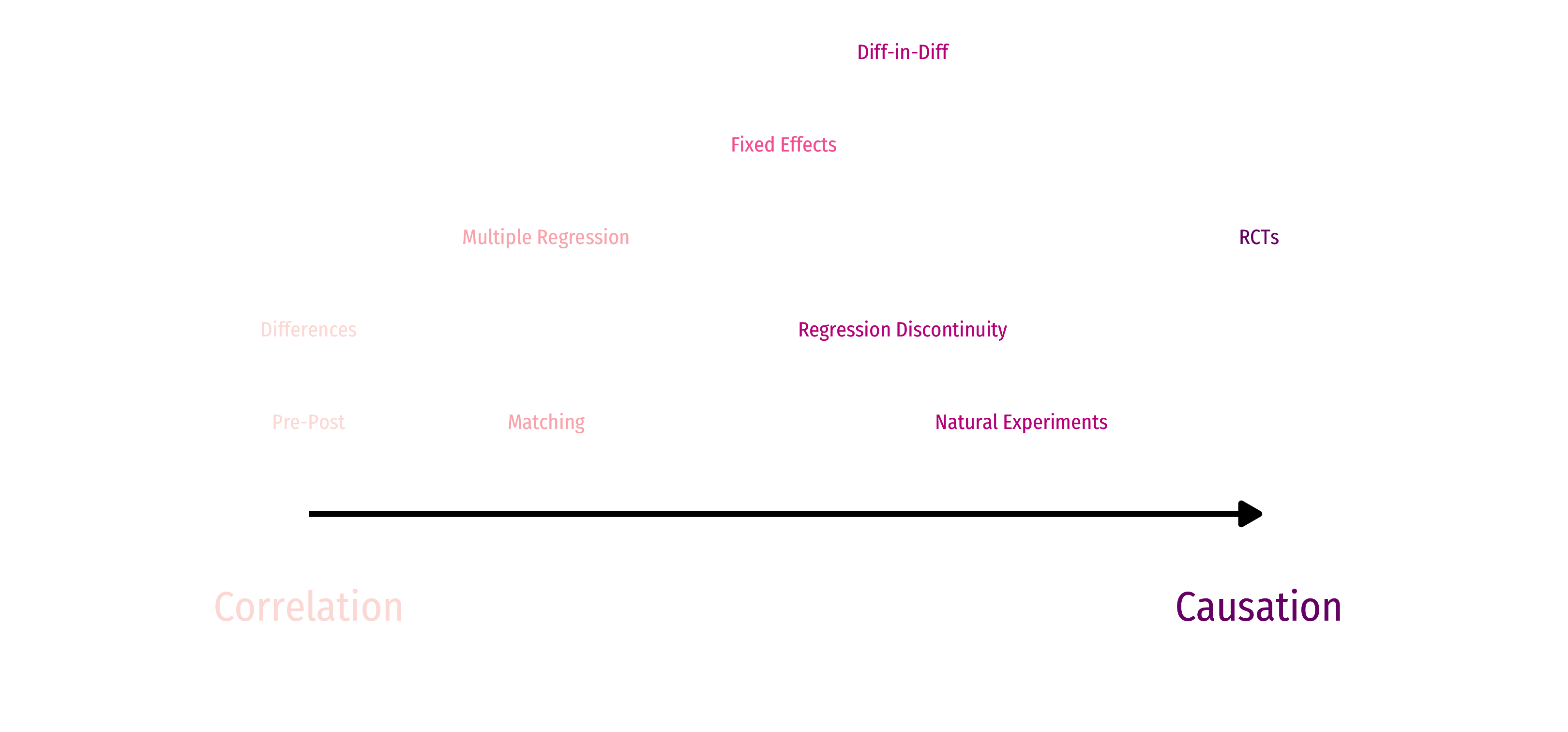

The Quest for Causal Effects I

RCTs are considered the “gold standard” for causal claims

But society is not our laboratory (probably a good thing!)

We can rarely conduct experiments to get data

The Quest for Causal Effects II

Instead, we often rely on observational data

This data is not random!

Must take extra care in forming an identification strategy

To make good claims about causation in society, we must get clever!

Natural Experiments

Economists often resort to searching for natural experiments

Some events beyond our control occur that separate otherwise similar entities into a "treatment" group and a "control" group that we can compare

e.g. natural disasters, U.S. State laws, military draft

Clever Research Designs Identify Causality

Multivariate Econometric Models Overview

Yi=β0+β1X1i+β2X2i+⋯+βkXki+ui

Multivariate Econometric Models Overview

Yi=β0+β1X1i+β2X2i+⋯+βkXki+ui

- Y is the dependent variable of interest

- AKA "response variable," "regressand," "Left-hand side (LHS) variable"

Multivariate Econometric Models Overview

Yi=β0+β1X1i+β2X2i+⋯+βkXki+ui

- Y is the dependent variable of interest

- AKA "response variable," "regressand," "Left-hand side (LHS) variable"

- X1 and X2 are independent variables

- AKA "explanatory variables", "regressors," "Right-hand side (RHS) variables", "covariates"

Multivariate Econometric Models Overview

Yi=β0+β1X1i+β2X2i+⋯+βkXki+ui

- Y is the dependent variable of interest

- AKA "response variable," "regressand," "Left-hand side (LHS) variable"

- X1 and X2 are independent variables

- AKA "explanatory variables", "regressors," "Right-hand side (RHS) variables", "covariates"

- Our data consists of a spreadsheet of observed values of (X1i,X2i,Yi)

Multivariate Econometric Models Overview

Yi=β0+β1X1i+β2X2i+⋯+βkXki+ui

- Y is the dependent variable of interest

- AKA "response variable," "regressand," "Left-hand side (LHS) variable"

- X1 and X2 are independent variables

- AKA "explanatory variables", "regressors," "Right-hand side (RHS) variables", "covariates"

- Our data consists of a spreadsheet of observed values of (X1i,X2i,Yi)

- To model, we "regress Y on X1 and X2"

Multivariate Econometric Models Overview

Yi=β0+β1X1i+β2X2i+⋯+βkXki+ui

- Y is the dependent variable of interest

- AKA "response variable," "regressand," "Left-hand side (LHS) variable"

- X1 and X2 are independent variables

- AKA "explanatory variables", "regressors," "Right-hand side (RHS) variables", "covariates"

- Our data consists of a spreadsheet of observed values of (X1i,X2i,Yi)

- To model, we "regress Y on X1 and X2"

- β0,β1,⋯,βk are parameters that describe the population relationships between the variables

- We estimate k+1 parameters (“betas”)

What are Good Independent Variables? I

Previous GDP per Capita

Investment share of GDP

Macroeconomic variables

Foreign Aid

Geography

Culture

Political institutions

What are Good Independent Variables? II

Recall we are limited by the data we can find and measure

A lot of variables used are proxy variables that are correlated with something we care about, but can't measure

- Inflation rate

- Ethnolinguistic fractionalization

- Region dummy variables

- "Black market premium on foreign exchange"

- Polity IV index of political institutions

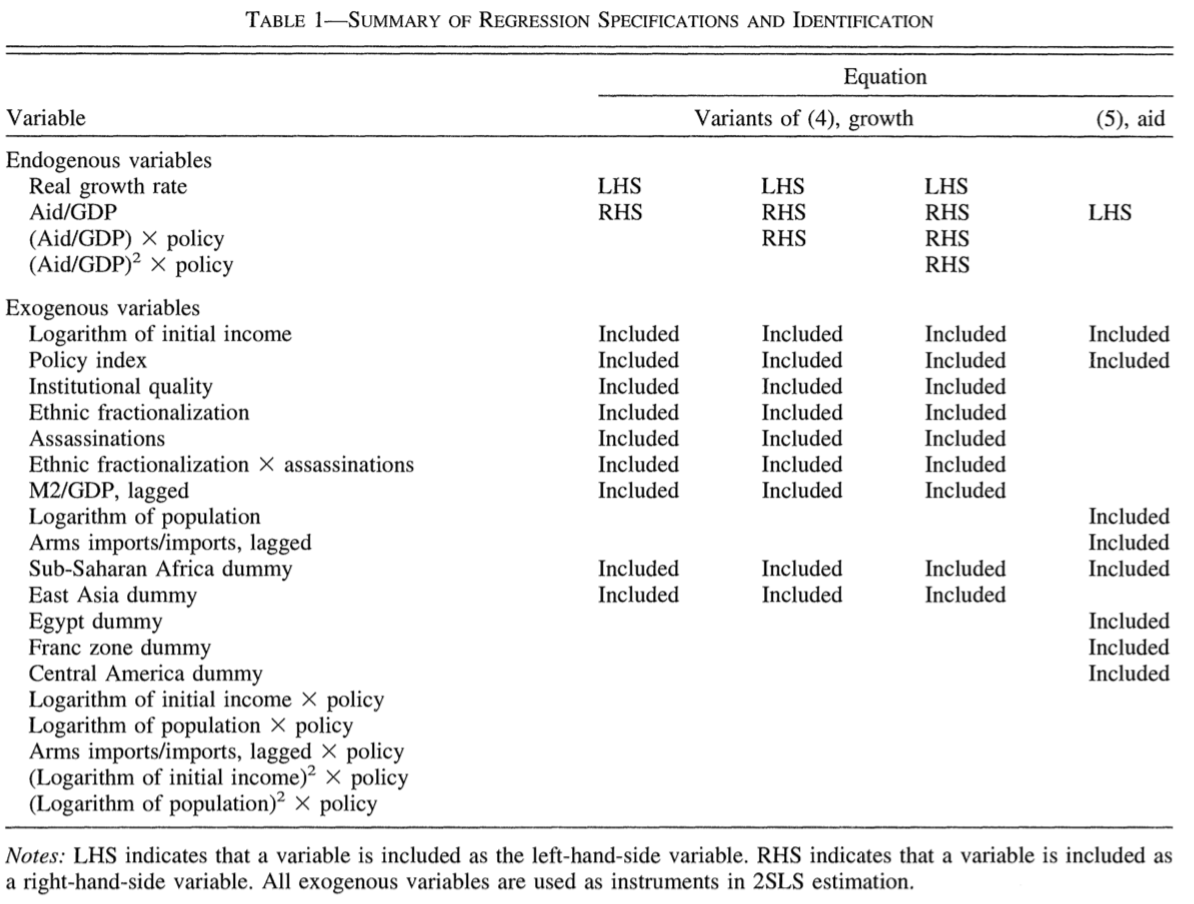

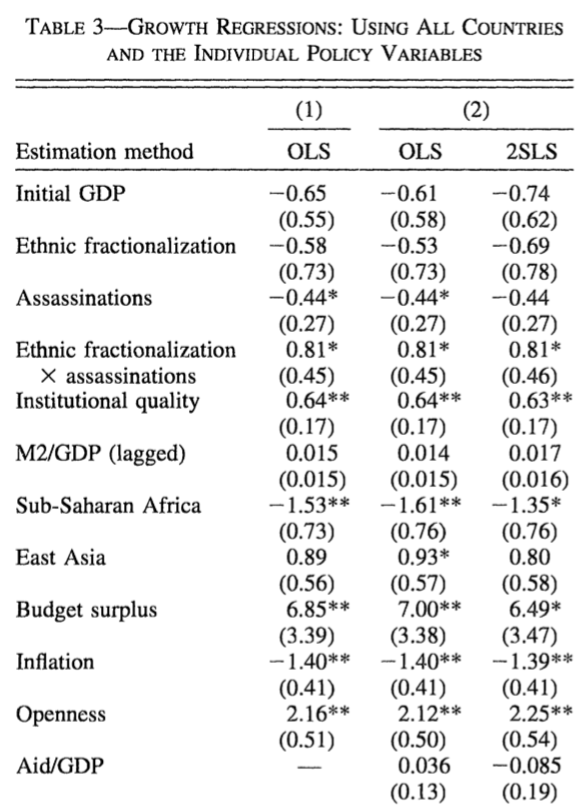

"Kitchen-Sink" Regressions

Burnside and Dollar (2000: 852)

Burnside, Craig and David Dollar, 2000, "Aid, Policies, and Growth," American Economic Review 90(4): 847-868

"Kitchen-Sink" Regressions

GDP per capita growth=β0+β1Initial GDP+β2+Ethnic fractionalization+β3Assassinations+β4Distance from equator+⋯

How to Read a Regression Table I

Each column is a particular model

Number next to each variable (row) is the marginal effect of that variable on outcome variable

- Holding other included variables constant

- A 1 unit change in that variable ⟹ a (that number) change in outcome variable

Number in parentheses below it is the standard error of the estimate

- If it is less than half of the estimate, statistically significant

Burnside, Craig and David Dollar, 2000, "Aid, Policies, and Growth," American Economic Review 90(4): 847-868

How to Read a Regression Table II

- R2: goodness of fit of regression

- Percent of overall variation in outcome explained by the model

- Higher is better (and rarer in the real world)

Burnside, Craig and David Dollar, 2000, "Aid, Policies, and Growth," American Economic Review 90(4): 847-868

Foreign Aid, A History

Aid for Growth

We restrict our exploration to foreign aid for the purpose of causing economic growth/development

NOT aid for humanitarian crises or natural disaster recovery

NOT aid for military/peacekeeping efforts

NOT aid for specific causes (i.e. reduce malaria)

- Note these might be related to economic growth!

Foreign Aid: A Timeline I

Historical ideas behind foreign aid as a necessary, desirable, or admirable goal of rich, Western countries

A moral imperative to “bring civilization” to lesser developed countries

- Imperialism, colonialism, scientific racism

Rudyard Kipling, “The White Man's Burden” (1899)

Foreign Aid: A Timeline II

1940s-1950s: World War II ends

1945-1951: Marshall Plan to rebuild war-torn Europe

1946: Harrod-Domar model -> "financing gap"

Foreign Aid: A Timeline III

1950s-1960s:

1960 Rostow's stages of growth model

Cold War starts, “Red scare” in U.S.

Foreign aid to “Rhird World” takes off, in part to protect it from Soviets

The Invention of "Development" and Foreign Aid

John F. Kennedy addressing USAID

“There is no escaping our obligations: our moral obligations as a wise leader and good neighbor in the interdependent community of free nations – our economic obligations as the wealthiest people in a world of largely poor people, as a nation no longer dependent upon the loans from abroad that once helped us develop our own economy – and our political obligations as the single largest counter to the adversaries of freedom.” – John F. Kennedy

- Foreign Assistance Act of 1961 creates U.S. Agency for International Development (USAID)

Source: USAID

Foreign Aid: A Timeline III

- Before 1980s:

- Protectionist trade-policies

- Import-substitution industrialization

La Decada Perdida

1982: Mexico announces it can no longer finance its debts

1980s Latin American debt crisis

Also in Africa and Middle East

1980s: The Rise of Structural Adjustment Lending

IMF and World Bank begin to make general loans (instead of for specific projects) to developing countries, conditional on "structural adjustment"

Governments would be required to make growth-enhancing policy changes in exchange for loans

What were these? Eventually became known as...

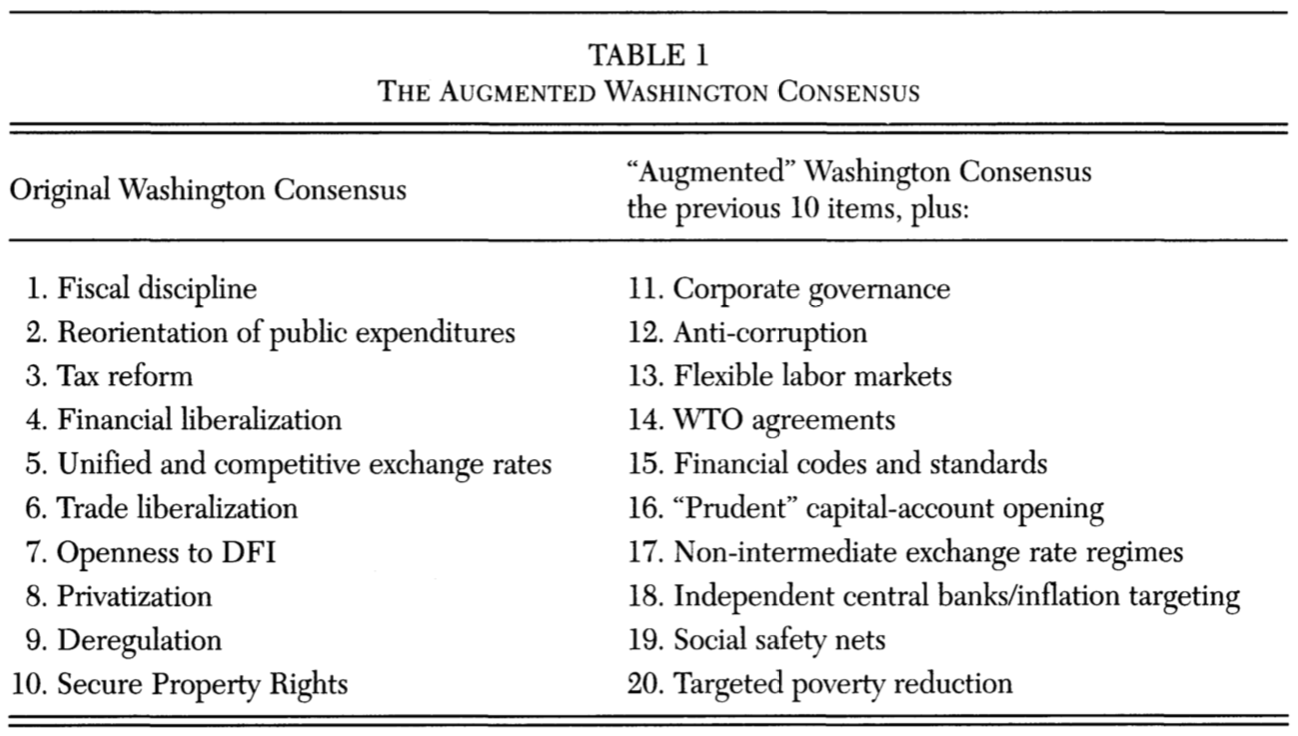

1990s: The Washington Consensus

Rodrik, Dani, 2006, "Goodbye Washington Consensus, Hello Washington Confusion?" Journal of Economic Literature 44(4): 973-987

Criticism of IMF, SAL, and Washington Consensus

Foreign Aid Today III

Foreign Aid Today IV

- 57% of American voters believe we give too much foreign aid (2017) Source: Rasmussen Reports

- 6% say it's not enough

27% say it's about right

Foreign aid is less than 1% of our federal spending

Foreign Aid Today V

The Theoretical Foundations of Foreign Aid

The Harrod-Domar Model

L: Roy Harrod (1900-1978)

R: Evsey Domar (1914-1997)

“Knife's Edge” equilibrium: a single savings rate and ICOR that permits stable growth

- Growth too low ⟹ depression

- Growth too high ⟹ hyperinflation

Highly simplistic, yet extremely influential

- Focus on unconsumed surplus to be used for investment

- GDP growth rate ∝ Investment share of GDP

- Tendency to think "Development" = Growth = Industrialization

- Ripe for top-down development policy & planning

The Harrod-Domar Model

L: Roy Harrod (1900-1978)

R: Evsey Domar (1914-1997)

“Financing gap” between “required” investment rate (predicted from model) and a country's actual saving rate

Low income countries can't increase savings ⟹foreign aid from countries with higher savings will lead directly to rapid growth1

1 Remember this argument!

The Harrod-Domar Model IV

William Easterly

1957-

“To sum up, Domar's model was not intended as a growth model, made no sense as a growth model, and was repudiated as a growth model. So it was ironic that Domar's growth model became, and continues to be today, the most widely applied growth model in economic history,” (p.28).

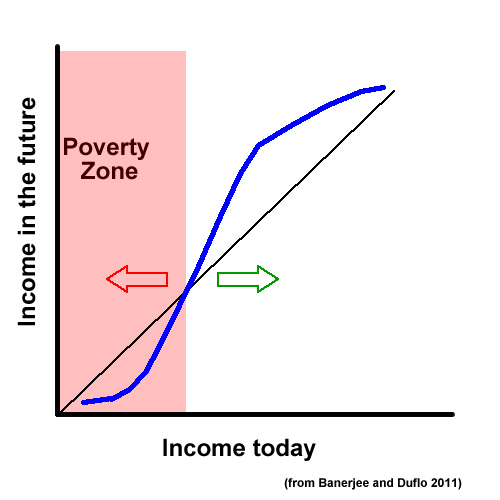

The Poverty Trap Argument

Poverty trap argument:

In order to escape poverty, people must invest in capital goods to improve productivity

In order to invest, people must first save some of their income

Low-income people need to spend all of their income on subsistence

Thus, they are trapped in a poverty trap